DOGE Price Prediction: Can Dogecoin Reach $1 Amid Bullish Momentum?

#DOGE

- Technical Breakout: DOGE is testing upper Bollinger Band with bullish MA alignment

- Institutional Catalysts: ETF speculation and $68M treasury purchase fuel demand

- Price Targets: $0.25 (near-term), $1 (long-term if momentum sustains)

DOGE Price Prediction

DOGE Technical Analysis: Bullish Signals Emerge

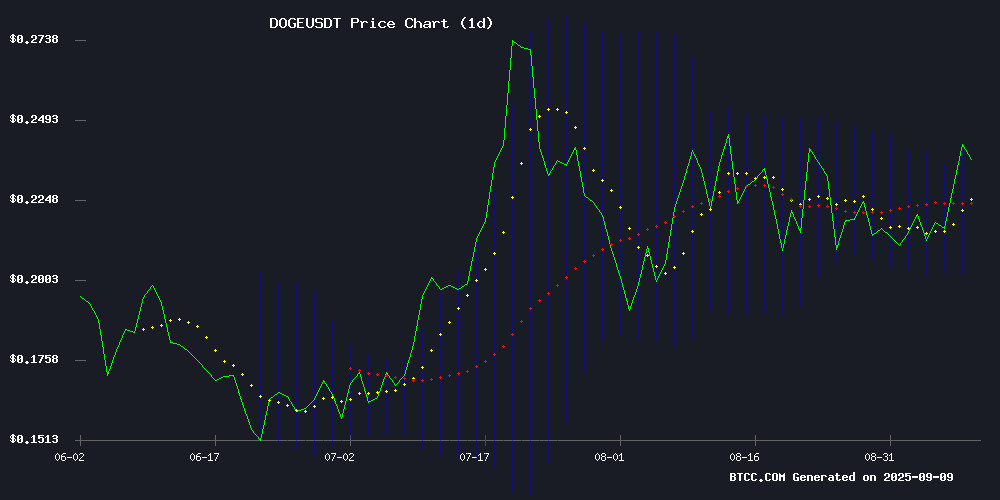

According to BTCC financial analyst Olivia, Doge is currently trading at $0.24017, above its 20-day moving average of $0.222052, indicating a bullish trend. The MACD shows a slight bearish crossover with a reading of -0.003219, but the price is testing the upper Bollinger Band at $0.242725, suggesting potential upward momentum. A break above this level could target the next resistance at $0.25.

Dogecoin Market Sentiment: Institutional Interest Fuels Rally

BTCC financial analyst Olivia notes that Dogecoin's price surge is backed by strong institutional demand and ETF speculation. News headlines highlight a 12% weekly gain, partnerships with major exchanges, and a $68M treasury purchase by CleanCore Solutions. These factors, combined with technical indicators, suggest growing bullish sentiment and potential for further upside.

Factors Influencing DOGE’s Price

Dogecoin Eyes $0.25 Breakout Amid Institutional Demand and ETF Speculation

Dogecoin consolidates near $0.24 as institutional interest surges, fueled by CleanCore Treasury's billion-dollar accumulation plan and rumors of a potential U.S. ETF. The meme coin's price action hinges on critical technical levels, with $0.25–$0.27 representing the next resistance zone to watch.

Support between $0.18–$0.20 has proven resilient during recent pullbacks, while a breach below could trigger deeper corrections. Analysts maintain $1 as a long-term target should bullish momentum sustain. The 24-hour trading range of $0.231–$0.244 reflects heightened volatility as traders weigh profit-taking against growing institutional participation.

Dogecoin and Remittix: Shifting Trends in Altcoin Investment

Dogecoin's meme appeal persists, but investors are increasingly eyeing utility-driven altcoins like Remittix for higher returns in 2025/26. Analysts note a cooling interest in traditional meme coins as the market pivots toward projects with real-world applications.

DOGE shows technical promise, trading around $0.232 with a bullish rounding-bottom pattern. Key resistance lies at $0.24–$0.25, while $0.209 serves as critical support. Whale activity, including a $230 million acquisition, signals potential momentum toward $0.30.

Remittix emerges as a standout, combining low fees, DeFi staking rewards, and a cross-border payment network. Its imminent exchange listing and tangible use cases position it as a rival to DOGE's community-driven hype.

Dogecoin Rallies 5% Ahead of Historic Spot ETF Launch

Dogecoin surged 5% to $0.2471 as markets anticipate the SEC's imminent approval of the Rex-Osprey Spot Dogecoin ETF. Traders now price in a 91% probability of approval, with the decision window closing September 13.

The potential ETF listing marks a watershed moment for the meme coin, previously dismissed by institutional investors. Nate Geraci, president of ETF Store, warns of 'wild' crypto ETF activity in coming months as regulatory barriers erode.

Market structure shifts are evident as DOGE stabilizes at $0.2465. The ETF approval could catalyze a reevaluation of Dogecoin's $32 billion market cap, with retail traders now eyeing the psychological $1 threshold.

DOGE Price Jumps 12% in a Week: Is the Next Big Breakout Near?

Dogecoin (DOGE) surged to $0.2404, marking a 2.88% gain in 24 hours as trading volume spiked 23.47% to $3.75 billion. The meme coin has climbed 12.79% over the past week, signaling renewed investor interest and bullish momentum.

Technical analysts note DOGE is testing the $0.24 resistance level that historically precedes rallies. The current chart pattern mirrors previous breakout formations, with traders anticipating a potential major move if the uptrend holds. Market participants are watching for a decisive close above this key level.

Dogecoin Breaks Into Bullish Zone, Eyes Key $0.238 Resistance

Dogecoin has surged into bullish territory after breaking above the Ichimoku Cloud, signaling potential upward momentum. The meme cryptocurrency now faces a critical test at $0.23804, a resistance level that could determine its near-term trajectory.

The Kumo breakout marks a technical turning point, with the cloud shifting from resistance to support between $0.21517 and $0.22661. This development suggests growing buyer interest, though sustained movement above $0.23804 is needed to confirm the bullish case.

Traders are watching the Kijun-sen line closely, as a decisive breach could open the door for further gains. The market appears poised at an inflection point—whether Dogecoin's rally has staying power or will face another consolidation phase.

House of Doge Partners with Bitstamp by Robinhood for Dogecoin Treasury Management

House of Doge, the corporate arm of the Dogecoin Foundation, has entered a strategic partnership with Bitstamp by Robinhood to manage the Official Dogecoin Treasury. The collaboration aims to enhance stability and transparency for DOGE's ecosystem treasury, leveraging Bitstamp's regulatory-compliant platform.

The move signals growing institutional confidence in Dogecoin's utility, with plans to explore yield-bearing opportunities for holders. Bitstamp's custody solution provides a secure foundation for House of Doge's financial operations, including engagement with miners and long-term stakeholders.

DOGE Price Surges 3.69% as Technical Indicators Flash Bullish Signals

Dogecoin rallied 3.69% to $0.24 amid strong technical momentum, with the MACD histogram showing positive divergence and RSI holding steady at 60.07. Trading volume remained robust at $389 million on Binance's spot market, underscoring sustained retail interest.

The move comes without significant news catalysts, suggesting purely technical drivers. Dogecoin's ability to maintain gains above key moving averages points to underlying strength in market structure. Analysts note the cryptocurrency is testing resistance levels that could trigger further upside if breached.

CleanCore Solutions Establishes Largest Dogecoin Treasury with $68M Purchase

NYSE-listed CleanCore Solutions, Inc. has made waves in the cryptocurrency market with its acquisition of 285 million DOGE, valued at $68 million. This strategic move positions CleanCore as the operator of the largest single Dogecoin treasury, with ambitions to accumulate 1 billion DOGE within 30 days and eventually hold 5% of the meme coin's circulating supply.

The purchase is backed by an $175 million private investment in public equity (PIPE) supported by institutional heavyweights including Pantera Capital and FalconX. CleanCore's treasury initiative, endorsed by the Dogecoin Foundation, aims to drive real-world adoption through payments, tokenization, and global remittance solutions.

Dogecoin's price action shows technical promise, currently trading around $0.24 after breaking out from a symmetrical triangle pattern. Market watchers suggest a successful retest of support levels could propel DOGE toward $0.33.

Dogecoin Defies Market Trends with 10% Weekly Surge Amid Whale Activity

Dogecoin has bucked broader market trends with a 10% weekly gain, fueled by a $3.82 billion 24-hour trading volume and growing interest in derivative tokens like Maxi Doge. The meme coin’s resilience highlights its enduring community strength, even as newer competitors emerge.

Macroeconomic tailwinds, including weak US jobs data and expectations of Fed rate cuts, have bolstered risk assets. Yet Dogecoin’s outperformance stands apart—its 142% year-to-date rally now positions it as a $35 billion market cap leader among meme coins.

Speculation around a potential Dogecoin ETF adds fuel to the rally, though questions linger about sustainability. Derivatives activity and whale accumulation suggest this may be more than a fleeting pump.

DOGE Price Swings 5.7% as Traders Target 25-Cent Threshold Amid Institutional Activity

Dogecoin exhibited volatile trading over the past 24 hours, with a 5.7% price range between $0.231 and $0.244. Institutional players entered near the $0.234 support level, driving a late-session recovery of 2% after heavy profit-taking capped earlier gains. Volumes surged to 463.5 million tokens during rejections at $0.244, signaling strong selling pressure, while 687.9 million tokens changed hands in the support zone, suggesting accumulation.

Technical indicators point to a critical juncture. The $0.234–$0.237 zone has emerged as firm support, with higher lows in the final 20 minutes indicating renewed bullish interest. A decisive break above $0.244 could open the path to $0.250, while failure may trigger a retest of the $0.231 base. Futures data reveals growing institutional hedging activity as market participants await potential U.S. regulatory developments on crypto ETFs.

Dogecoin Rally Could Push Price to $4: Analyst Forecast

Dogecoin (DOGE) is gaining traction among traders as technical indicators signal a potential bullish trend. Chartist Cantonese Cat (@cantonmeow) suggests DOGE may be entering its third major cycle, with a structurally sound base forming across daily, weekly, and monthly charts. "I’m extremely bullish on Dogecoin. The current advance looks a lot healthier than the last cycle," the analyst noted.

Key technical setups support the upside. The 20-month moving average on monthly charts is acting as a pivot, while the Ichimoku Cloud re-entry through consolidation—rather than a sharp spike—points to sustainable momentum. A cup-and-handle formation, confirmed by Fibonacci retracement levels, further underscores the orderly mid-cycle digestion.

Will DOGE Price Hit 1?

While DOGE shows strong bullish signals, reaching $1 would require a 316% surge from current levels ($0.24017). Key factors to monitor include:

| Factor | Impact |

|---|---|

| Institutional Demand | High (ETF speculation, treasury purchases) |

| Technical Resistance | $0.25 (near-term), $0.50 (mid-term) |

| Market Sentiment | Extremely bullish (12% weekly gain) |

Analyst Olivia suggests that while $1 is possible in a long-term bull market, traders should watch for sustained breaks above $0.25 first.